If you don’t use your SBI bank account for a long time then your account will become inactive. To reactivate your dormant account, write a request letter to the bank manager and submit it along with your KYC like Aadhar and PAN copies.

Not only for SBI, but even for other banks like HDFC Bank, ICICI, Kotak, Canara, Punjab National Bank, Bank of Baroda, etc. for all those banks the process is almost the same.

Here you can find sample dormant account activation letters in Word format.

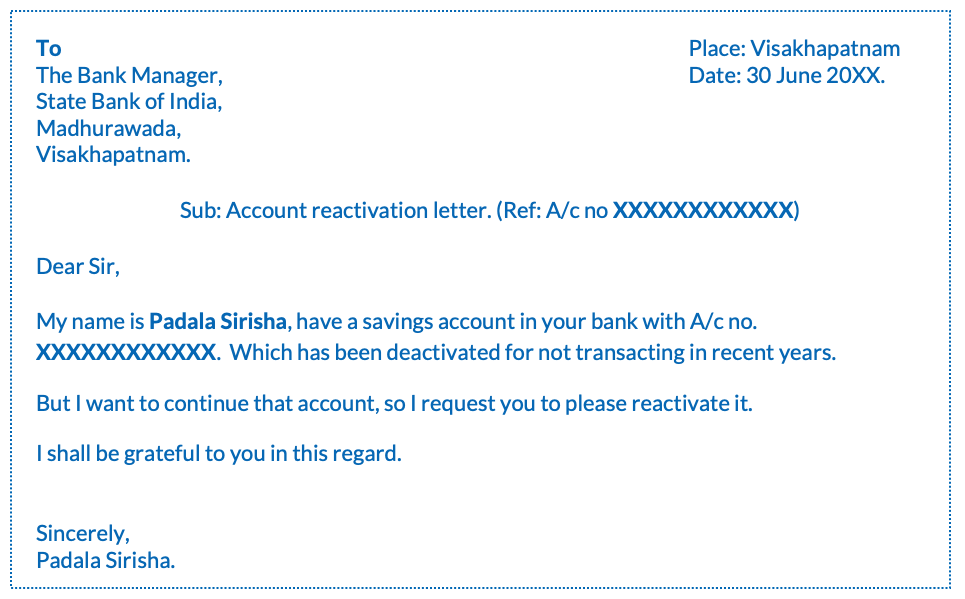

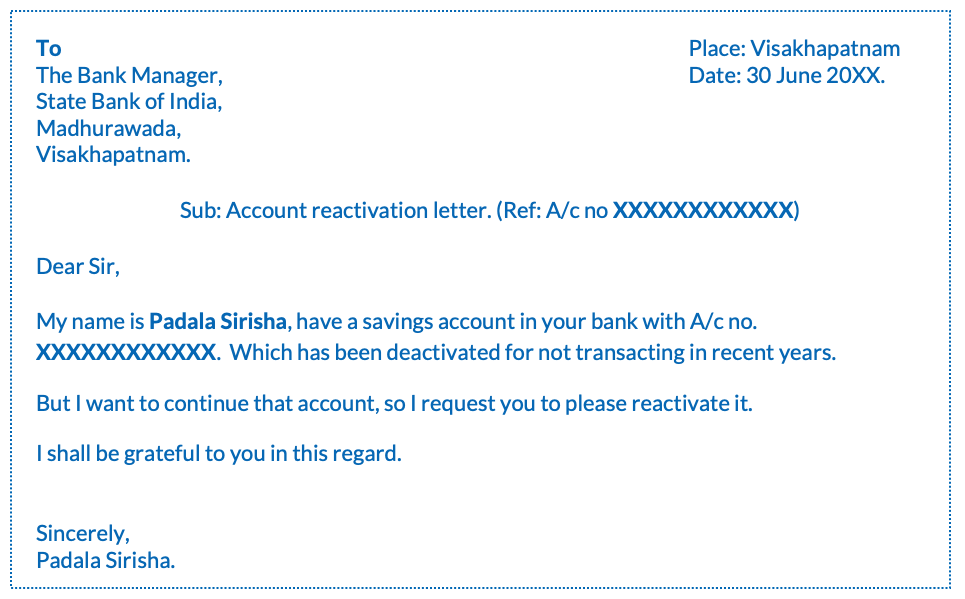

To

The Bank Manager,

State Bank of India,

Madhurawada,

Visakhapatnam.

Sub: Account reactivation letter. (Ref: A/c no XXXXXXXXXXX)

My name is Padala Sirisha, have a savings account in your bank with A/c no. XXXXXXXXXXX. Which has been deactivated for not transacting in recent years.

But I want to continue that account, so I request you to please reactivate it.

I shall be grateful to you in this regard.

To

The Bank Manager,

State Bank of India,

Address.

Sub: Dormant account activation application.

My name is [your name] account holder of your bank with savings bank a/c no [XXXXXXXXX]. I have been out of station for the last __ years so that I couldn’t use my bank account.

But recently I found out that my account has become inactive, but I would like to reactivate it.

Therefore I request you to please activate my bank account so that I can avail your banking services.

![]()

To

The Branch Manager,

Bank name,

Address.

Sub: Account reactivation letter.

I am [your name], holding a savings bank account with a/c no. [XXXXXXXXX] at [bank name]. The account was opened by my company, but after leaving the job I didn’t make any financial transactions for the last __ years through this account.

Now I realized that my account has become dormant and I want to reactivate it so that I can use your banking services.

Therefore I request you to kindly reactivate my account and please find the enclosed KYC documents such as my Aadhar and PAN copies with this letter.

I shall be obliged to you in this matter.

![]()

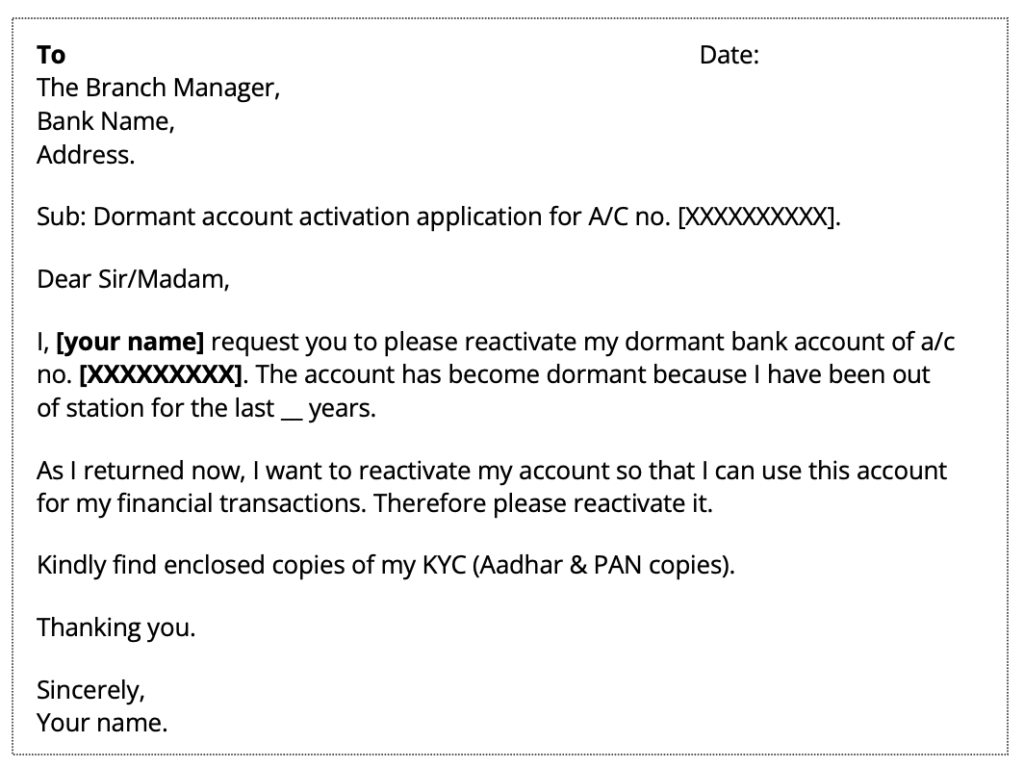

To

The Branch Manager,

Bank Name,

Address.

Sub: Dormant account activation application for A/C no. [XXXXXXXXXX].

I, [your name] request you to please reactivate my dormant bank account of a/c no. [XXXXXXXXX]. The account has become dormant because I have been out of station for the last __ years.

As I returned now, I want to reactivate my account so that I can use this account for my financial transactions. Therefore please reactivate it.

Kindly find enclosed copies of my KYC (Aadhar & PAN copies).

After how many years the bank accounts will become dormant/inoperative?

In 2 years, most banks will make your account dormant if you don’t use it for any financial transactions and also if the minimum balance is not maintained.

How much time will it take to reactivate my dormant bank account?

If you submit a written request letter to the bank, then within 1-2 days your account will become active.

Can I activate my dormant account online?

No, you cannot do it online, you have to visit your bank’s branch directly.

Can banks charge to activate dormant accounts?

No, there is no need to pay any charges to activate a dormant bank account.

Also Read: